First of you should know what is TDS? In India Tax deducted at source (Tds ) is an indirect method of collecting income tax by income tax deptt. Such collection of tax has an effect at the source when income arises or accrues .The buyer (deductor ) deduct the tax from the payment made to the seller (deductee and remits the tax to the income tax department within the stipulated time .The buyers make payment ( such as salary , rent , interest on securities , dividends , insurance commission , professional fees , commission on brokerage ,commission on lottery tickets , etc. ) to the sellers (services ) and deduct the requisite amount from such payments towards tax .The buyer files the TDS returns containing details of the seller and the bank , where the TDS amount is deposited to the income tax department (ITD) .The income tax department has prescribed the formats for filing these returns electronically , which the buyer submits in a cd/floppy.

Who is required to file e-tds return ?

Who is required to file e-tds return ?

The income tax department has made it mandatory for all corporate companies like private limited and public limited to file their tds return in electronic media (3-tds returns ).Non corporates like individuals , proprietary firms and partnership firms can furnish their returns in physical form to their respective income tax offices. They can also furnish their return in electronic form through TIN faciliatation center established by NSDL filling of e-tds return to non corporate deductors is optional .Filling e-tds returns The buyer / deductors has to furnish the tds returns in electronic form and form 27A in physical form along with the e - tds return cd/floppy.

- TDS in tally 7.2 TDS in tally 7.2 provides an easy to use interface with complete flexibility.It helps you to handle any intericate cases and to calculate the tax amount payable to the income tax department .Features of TDS in tally 7.2The tds functionality in tally 7.2 provides the following features

- 1. it is simple and user friendly

- 2. It is quick and easy to setup and use

- 3. Partial / full payment of tax can be deducted

- 4. Provision for auto and manual calculation of TDS amount

- 5. It generate tds challan and exceptional reports

- 6. Complete tracking of each transaction from deduction to payment

- 7. Challan management and printing ensures prompt and accurate filing of tax.

- 8. The auto allocation feature prevents error prone data entry and helps to track the transactions faster.

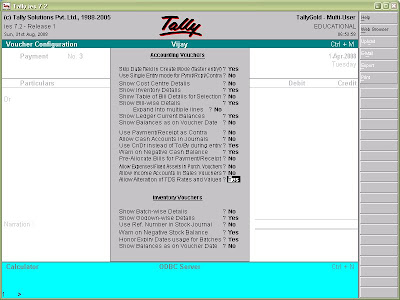

- Enabling tds in tally You can enable tally tds by pressing F11 : features button .This screen helps you to activate the tds feature.Click gateway of tally--> click on the F11: features button or press the F11 key 1. set enable TDS option to Yes 2. Set set modify other company features ? to yes . You will see the advanced company operations dialog window w as shown below3. Set enter tds deductor details to yes will display the below dialog window Tax assessment number Enter the tax assessment number (TAN) in this field .The tax assessment number is a ten digit alphanumeric number which is issued by the income tax department to the deductors .The format of the 10 digit TAN is something like this cccc NNNNN A

- 1. first three letters indicate the location code of the tan allotment center

- 2. next letter indicates the first alphabet of the deductor name .

- 3. Next five numerals indicate the number within each location .Last character is the check digit for security and verification Income tax circle / ward (TDS)Enter the income tax circle / ward(TDS).Income tax department issues income tax circle /Ward (TDS)Deductor type Select the deductor type (Co. Or non company)Name of person responsible Enter the name ofthe authorised person who is responsible to file the tds returns of your company .Designation Enter the designation of the authorised person for filling the TDS returns TDS master creation The information required for TDS in the creation of ledgers depends on the features opted by you in the F11 features screen .If you set enable TDS F11 features to no then you will not find any TDS related information in the creation of ledger The TDS related issues are created as ledgers .The TDS ledger master screen now contains a new option to specify the tax details.First of all create the following ledgers under different group

- 1.Tax ledger under duties and taxes

- 2. Party ledger under sunder creditors/ debtors Creating tax ledger The tax ledgers are created under the group duties and taxes .The group duties and taxes is automatically used for calculation of tax .This ledger holds the entire automatic calculation for tds tax deductions at the voucher entry level .It is internally enabled to calculate the tax.

You can take help also with pictures of accounting treatment of Tds

I found this information really helpful. Thanks for sharing the informative post.

ReplyDeleteTDS Return Form