If you are operating tally 9 at its advance level, then you have already known what is the difference between TDS and TCS. Both are the statutory and taxation feature and both is used pursuance of the provision of TDS rules and TCS rules of income tax act 1961.

Differences between TDS and TCS

3. Suppose Manoj is our debtor and we sell him forest product so , we have to write yes in apply tcp in the ledger creation of manoj .

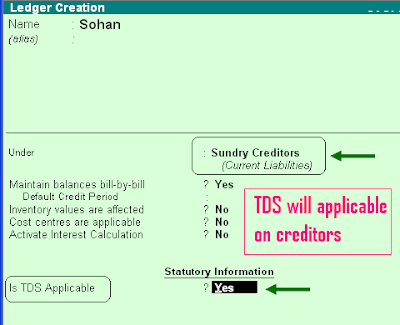

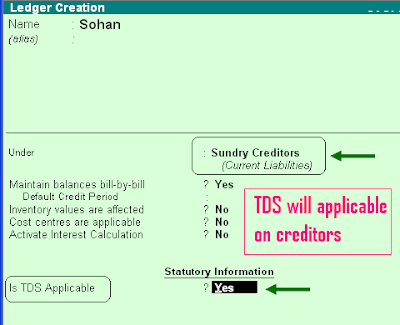

4. When we have to pay sohan who is our creditor because we have to give commission on sale ticket so we have to write yes i n front of is TDS applicable in the ledger creation of sohan

5. Voucher entry of TDS will be in the payment voucher . Suppose if we have to pay Sohan 14000 , then we have to 10000 net and 4000 will transfer to TDS account ( Before making the voucher entry , ensure that you have made TDS account under Duty and tax group.)

6. Voucher entry of TCS will be in receipt voucher . Suppose we have gotten 14000 from manoj for sale of forest product , then you have to net receipt 10000 from manoj and other 14000 will transfer to TCS account .

Differences between TDS and TCS

- TDS means tax deducted at source and TCS means tax collected at source. One of main example of TDS is amount of tax deducted from employee's salary . When an employee gets salary , it is duty of employer to deduct tds from his salary and deposit it in the account of Govt. When company pays salary , all salary is not given to employee but company's employer deducts tax from this payment , so tds is also part of company's expenses .It is also duty of employer to deposit this amount to the specific bank which is authorised by Income tax department . But there are also other payments like interest or commission on sale lottery tickets or brokerage or payment to contractor and subcontractor etc. But many other cases when company received certain amount, at this time tax amount is collected from employee and so it becomes TCS , Suppose , if company sells forest products and gets money with tax collected at source , this is the part of revenue .

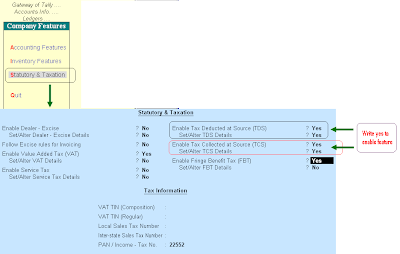

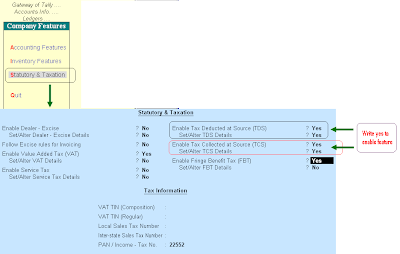

- There are two button in Tally's statutory and taxation feature one is for TDS and other is for TCS , So , there are facility for using both facilities you have to write yes in both button because both are different from accounting point of view

3. Suppose Manoj is our debtor and we sell him forest product so , we have to write yes in apply tcp in the ledger creation of manoj .

4. When we have to pay sohan who is our creditor because we have to give commission on sale ticket so we have to write yes i n front of is TDS applicable in the ledger creation of sohan

5. Voucher entry of TDS will be in the payment voucher . Suppose if we have to pay Sohan 14000 , then we have to 10000 net and 4000 will transfer to TDS account ( Before making the voucher entry , ensure that you have made TDS account under Duty and tax group.)

6. Voucher entry of TCS will be in receipt voucher . Suppose we have gotten 14000 from manoj for sale of forest product , then you have to net receipt 10000 from manoj and other 14000 will transfer to TCS account .

COMMENTS