Problem

I am Accountant in Singapore . I have some doubts in Tally. Can you please clarify my doubts?

1) Purchase stock from USA CO. USD$ 4089.00 while purchase time the exchange rate is 1.466.

Entry I post in Tally ERP 9.0:(F9)

Purchases A/C Dr → USD$ 4089 x 1.466 → S$ 5994.47

USA CO. Cr → S$5994.47

Payment made by TT to USA CO. same USD$ 4089.00 , But the exchange rate is 1.434.

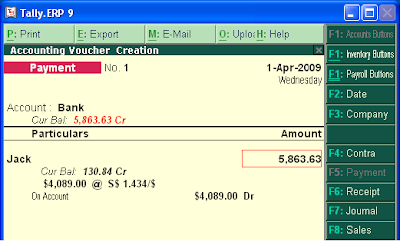

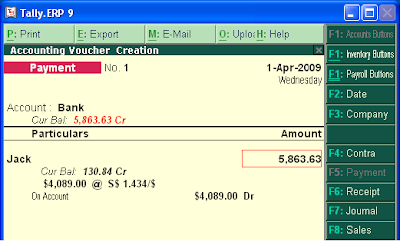

Payment (F5)

USA CO. A/C Dr → USD$ 4089 x 1.466 → S$5994.47

Forex Rate Cr → S$ 130.84

Bank Cr → S$ 5863.63

Is it correct or Wrong, If it wrong means ,please tell me the correct posting in Tally.

More clear the problem , I have obtained from Yahoo Chat

In previous company they adjusted exchange rate automatically. once I did payments it will come automatically. but in new company they didn't set up Tally properly.

Solution

When we purchase or sale from other country. At that time, we face multicurrency problem. Different countries exchange rate is different. In India, Value of Dollar $ is Rs. 49. Value of Singapore dollar Rs. 34. In Singapore, Value of Dollar $ is 1.421 Singapore dollars. These currencies are fluctuating day to day. Suppose today value of dollar $ is Rs. 49, yesterday, it may be Rs. 48. So, It is very necessary to know, what is the amount of profit or loss due to change in foreign exchange rate when we will buy or sell the goods. This is the basic knowledge for every reader.

Now, I try to solve above problem.

If you can operate Tally.ERP 9 , then you can understand it that Tally.ERP 9 provides easiest way to track forex profit or loss . In your above example

Your first entry is correct

Purchases A/C Dr →USD$ 4089 x 1.466→ S$ 5994.47

USA CO. Cr→ S$5994.47

Your second journal entry is also correct. But way of feeding is not correct.

You will pass the second entry with exchange rate 1.434 with mentioning forex profit or loss in payment Voucher of Tally.ERP 9

USA Co. Dr. US $ 4089

Bank Account Cr. US $ 4089

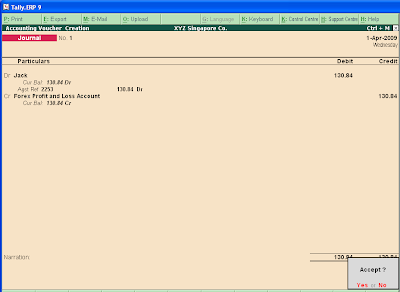

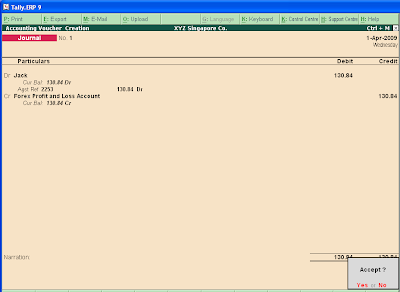

Now tally calculate automatically profit or loss due to changing the value of foreign exchange and it can be seen in also in balance sheet . For transferring this profit to profit and loss’s income side . You have to pass the following journal entry in Journal voucher .

USA Company Dr. ( I have taken it jack ) S $ 130.84

Forex Profit and loss account Cr. S $ 130.84

Click image for full view

</ small>

First of all create forex profit and loss account under indirect income and then pass the above voucher entry in journal voucher .

After this you can see forex earning in profit and loss account .

related Video : Recording of multicurrency transactions in tally 9

I am Accountant in Singapore . I have some doubts in Tally. Can you please clarify my doubts?

1) Purchase stock from USA CO. USD$ 4089.00 while purchase time the exchange rate is 1.466.

Entry I post in Tally ERP 9.0:(F9)

Purchases A/C Dr → USD$ 4089 x 1.466 → S$ 5994.47

USA CO. Cr → S$5994.47

Payment made by TT to USA CO. same USD$ 4089.00 , But the exchange rate is 1.434.

Payment (F5)

USA CO. A/C Dr → USD$ 4089 x 1.466 → S$5994.47

Forex Rate Cr → S$ 130.84

Bank Cr → S$ 5863.63

Is it correct or Wrong, If it wrong means ,please tell me the correct posting in Tally.

More clear the problem , I have obtained from Yahoo Chat

In previous company they adjusted exchange rate automatically. once I did payments it will come automatically. but in new company they didn't set up Tally properly.

Solution

When we purchase or sale from other country. At that time, we face multicurrency problem. Different countries exchange rate is different. In India, Value of Dollar $ is Rs. 49. Value of Singapore dollar Rs. 34. In Singapore, Value of Dollar $ is 1.421 Singapore dollars. These currencies are fluctuating day to day. Suppose today value of dollar $ is Rs. 49, yesterday, it may be Rs. 48. So, It is very necessary to know, what is the amount of profit or loss due to change in foreign exchange rate when we will buy or sell the goods. This is the basic knowledge for every reader.

Now, I try to solve above problem.

If you can operate Tally.ERP 9 , then you can understand it that Tally.ERP 9 provides easiest way to track forex profit or loss . In your above example

Your first entry is correct

Purchases A/C Dr →USD$ 4089 x 1.466→ S$ 5994.47

USA CO. Cr→ S$5994.47

Your second journal entry is also correct. But way of feeding is not correct.

You will pass the second entry with exchange rate 1.434 with mentioning forex profit or loss in payment Voucher of Tally.ERP 9

USA Co. Dr. US $ 4089

Bank Account Cr. US $ 4089

Now tally calculate automatically profit or loss due to changing the value of foreign exchange and it can be seen in also in balance sheet . For transferring this profit to profit and loss’s income side . You have to pass the following journal entry in Journal voucher .

USA Company Dr. ( I have taken it jack ) S $ 130.84

Forex Profit and loss account Cr. S $ 130.84

First of all create forex profit and loss account under indirect income and then pass the above voucher entry in journal voucher .

After this you can see forex earning in profit and loss account .

related Video : Recording of multicurrency transactions in tally 9

COMMENTS