Debit and credit are two sides any entry and any account. Without correct account mentioned in debit or credit, we can not get correct result. Debit and credit one of important concept of accounting. So, it is the duty of financial accounting teacher to teach debit and credit. Good teaching of debit and credit will make perfect your students in accounting. If you want to teach debit and credit better way, you should learn three methods of teaching of debit and credit first which I am explaining in following content.

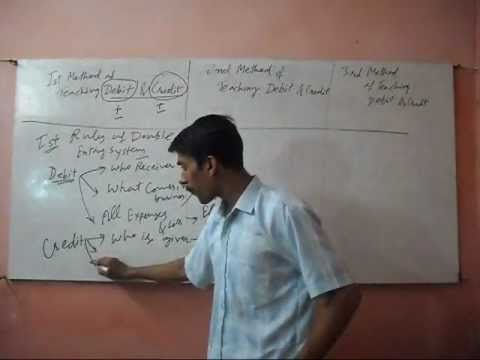

1st Method of Teaching of Debit and Credit - Explain the Rules of Double Entry System

If you will start to explain the rules of double entry system. You have to teach that every transaction will affect of two accounts in two different side. Each side may be debit or credit. Now, questions is which side will be debit or credit? It depends on the nature of transaction and applied double entry rule on it.

Debit

i) If a person, firm or any company receives anything from you or your business, you have to debit that person, firm or company.

ii) If anything comes in your business, you have to debit that thing.

iii) If you have consumed any service and you have paid the expenses for this, you have to debit that expenses.

Credit

i) If a person, firm or any company gives anything to you, you have to credit that person, firm or company.

ii) If anything goes from your business, you have to credit to that thing.

iii) If you have provided any service and you have gotten money of your service, you have to credit that revenue.

Following my video may be helpful explain more about double entry system.

1st Method of Teaching of Debit and Credit - Explain the Rules of Double Entry System

If you will start to explain the rules of double entry system. You have to teach that every transaction will affect of two accounts in two different side. Each side may be debit or credit. Now, questions is which side will be debit or credit? It depends on the nature of transaction and applied double entry rule on it.

Debit

i) If a person, firm or any company receives anything from you or your business, you have to debit that person, firm or company.

ii) If anything comes in your business, you have to debit that thing.

iii) If you have consumed any service and you have paid the expenses for this, you have to debit that expenses.

Credit

i) If a person, firm or any company gives anything to you, you have to credit that person, firm or company.

ii) If anything goes from your business, you have to credit to that thing.

iii) If you have provided any service and you have gotten money of your service, you have to credit that revenue.

Following my video may be helpful explain more about double entry system.

Recently, I have made a funny video in which I have tried to explain debit and credit. Teacher should be source of entertainment. Fun and enjoy make difficult things very easy. So, teacher should bring change in himself and after this, he can teach accounting or any other subject better way.

3rd Method of Teaching Debit and Credit - Explain Debit and Credit by Accounting Equation Rule

We know that accounting equation is Assets = liabilities + owner's equity + revenue - expenses.

If any transaction happens, before selecting debit or credit any accounting, you think the changes in the elements of accounting equation.

For Debit

(a) If there is any increase in asset.

For example we buy furniture, it increases our asset, so furniture account will debit.

(b) If there is any decrease in liability

For example we pay our long term loan, so long term loan account will debit.

(c) If there is decrease in owner's equity.

for example, owner of company gets the product of $ 2000 of business for personal use. With this transaction owner's equity will decrease, we will be debit to capital or drawing account.

(d) If there is any decrease in the revenue.

For example, we get loss of $ 1500 due to cheating by our accountant in counting of money. This is loss of our business. It decreases our revenue, so loss by cheating accounting will be debit.

( e) If there is any increase in the expenses

For example, we pay electricity bill of $ 600, this will increase our expenses, so we will be debit to electricity account with $ 600

For Credit

(a) If there is any decrease in asset.

For example we sell furniture, it decreases our asset, so furniture account will be credit.

(b) If there is any increase in liability

For example we have gotten long term loan, so long term loan account will be credit.

(c) If there is any increase in owner's equity.

for example, we issued $ 500000 new equity shares to shareholder. This $ 500000 will increase our owner's capital, so this equity capital account will be credit.

(d) If there is any increase in the revenue.

For example, our cheated accountant became honest and returned our $ 1500 which he collected from our business with cheating. This is increase of our revenue of our business. So Loss recovered account will be credit.

( e) If there is any decrease in the expenses

For example, we get 10% discount for paying electricity bill 10 days before the maturity. So, discount on advance payment of bill account will be credit. Because it will decrease our expenses.

Thank you for explaining the three ways of teaching Debit & Credit , and it was very clear .

ReplyDeleteBest Regards,

Mehdi Elfadil A. Hasan

it really clear my concept thank u for explaining.

ReplyDeleteregards, Kiran Soomro

Thank you sooo much for this!! New instructor here.

ReplyDelete