Question Asked by Student

Hello sir

I am professional accountant I am working as accountant since 2006. I already used tally 6.2, 7.2 and new I want to use tally 9. Recently I join a manufacturing company. so plz tell me how I set up manufacturing inventory on tally 9 I mean direct material and indirect material etc and tell me also how tally calculate cost of finish goods and do tally maintain cost of finish goods statement ? Thanks regard

Answered by Accounting Teacher

Dear student , If have already worked on tally then it is very easy to understand accounting treatment of inventory for manufacturing company. I am giving answer of your question one by one

(I) How I set up manufacturing inventory on tally 9 I mean direct material and indirect material etc?

Ans. In tally there is no extra rule for recording of inventory for manufacturing company. But If have you different Godown, you can set up Maintain multiple Godowns as same for trading company. After this you must

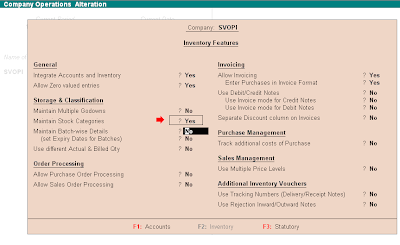

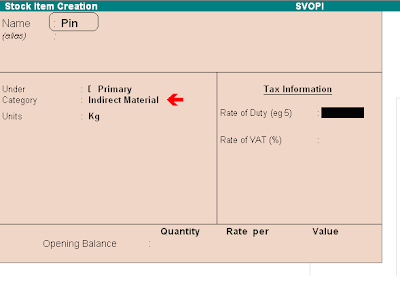

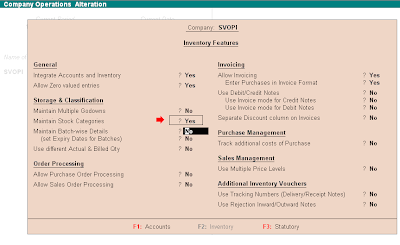

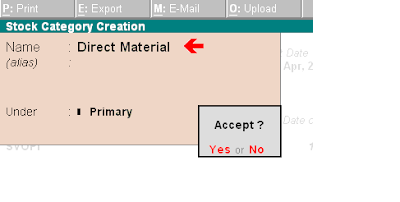

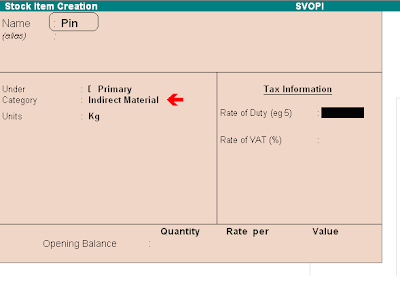

Create different unit of Measure in inventory info. And also create stock items. These stock items only include raw materials different items which will helpful to track the raw material purchase, cost of goods sold and closing stock of raw material. After this you have to create ledger of purchase, sale because it is often manufacturing company sells scrap, so for recording of scrap, you have to create sale ledger. And after this you can pass voucher entries relating to purchasing, payments of different expenses. If you want to record direct material and indirect material and display in tally inventory reports then you can make yes inventory feature of maintain cost category.

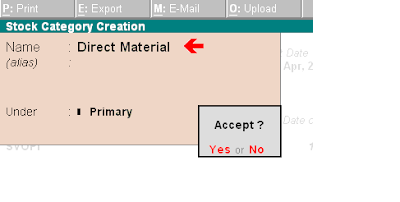

First your can make cost category , like direct material , direct labour , direct overheads , indirect material , indirect labour , indirect overhead and then make stock items under different cost category .

(II) tell me also how tally calculate cost of finish goods and do tally maintain cost of finish goods statement ?

If you will calculate the cost of finish goods then what is benefit of tally . Why have you invested your money on Tally the accounting software . If you have passed all voucher entry of different purchase , expenses correctly , tally automatically calculates cost of finished goods and you can see also in inventory report any time , Even you can change your profit and loss account as manufacturing accounting for your own purpose .

Thanks for query and give me opportunity for answer

From Vinod Kumar

Hello sir

I am professional accountant I am working as accountant since 2006. I already used tally 6.2, 7.2 and new I want to use tally 9. Recently I join a manufacturing company. so plz tell me how I set up manufacturing inventory on tally 9 I mean direct material and indirect material etc and tell me also how tally calculate cost of finish goods and do tally maintain cost of finish goods statement ? Thanks regard

Answered by Accounting Teacher

Dear student , If have already worked on tally then it is very easy to understand accounting treatment of inventory for manufacturing company. I am giving answer of your question one by one

(I) How I set up manufacturing inventory on tally 9 I mean direct material and indirect material etc?

Ans. In tally there is no extra rule for recording of inventory for manufacturing company. But If have you different Godown, you can set up Maintain multiple Godowns as same for trading company. After this you must

Create different unit of Measure in inventory info. And also create stock items. These stock items only include raw materials different items which will helpful to track the raw material purchase, cost of goods sold and closing stock of raw material. After this you have to create ledger of purchase, sale because it is often manufacturing company sells scrap, so for recording of scrap, you have to create sale ledger. And after this you can pass voucher entries relating to purchasing, payments of different expenses. If you want to record direct material and indirect material and display in tally inventory reports then you can make yes inventory feature of maintain cost category.

First your can make cost category , like direct material , direct labour , direct overheads , indirect material , indirect labour , indirect overhead and then make stock items under different cost category .

(II) tell me also how tally calculate cost of finish goods and do tally maintain cost of finish goods statement ?

If you will calculate the cost of finish goods then what is benefit of tally . Why have you invested your money on Tally the accounting software . If you have passed all voucher entry of different purchase , expenses correctly , tally automatically calculates cost of finished goods and you can see also in inventory report any time , Even you can change your profit and loss account as manufacturing accounting for your own purpose .

Thanks for query and give me opportunity for answer

From Vinod Kumar

Read Also

__________________________________________________

How to solve unit cost of sales

ReplyDelete