First of all, I want to tell that in Income tax Law 1961, TDS is the way of collecting tax from assessee. TDS is deducted by the person who pays to other certain amount which is mention in TDS sections. So, learn its accounting procedure or accounting treatment and journal entries in Tally.ERP 9.

There are two way of accounting treatment of TDS in Tally 9 or Tally.ERP 9 . I am writing both the way of accounting treatment and effect of it is same .

Automatic Way

Following are the simple steps for Accounting treatment , Voucher entries and return making of TDS in Tally.ERP 9 .

First Step

First of all go to Tally 9 Gateway Press F11 and go to Statuary & Taxation and Set Enable TDS as YES.

Second Step

i) Then create a Ledger account in the name of TDS Account under the group Duties & Taxes (Under C. liabilities).

ii) Type of Duty or Tax select as TDS

iii) Nature of Payment- for example you can select Payment of rent on buildings

iv) Ignore TDS Exemption limit- YES/ No

Third Step

(i) Then create another ledger account. For example create YZ. Company under the group of S.Creditors (job work).

(ii) Maintain Bill by Bill- YES.

(iii) Is TDS Applicable- write → YES Enter TDS details like Deductee type- whether Individual or Company. Then fill the required items.

Fourth Step

Then create another ledger account of rent account under indirect expenses.

Fifth Step

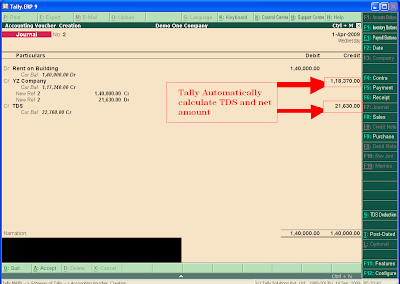

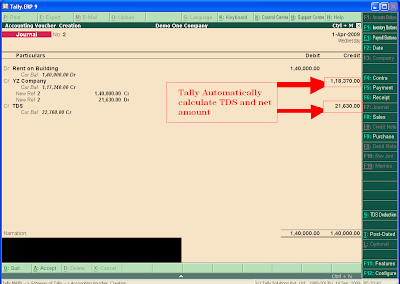

(i)Enter the transaction in Journal voucher.

Rent A/c. Dr.→ Rs 140000

YZ co. A/c. Cr. → Rs. 118370

TDS A/C Cr. → Rs. 21630

( Tally will select only one transaction TDS amount automatically , if not activate then calculate yourself and write )

Sixth Step

Then Payment entry ( Write same amount of TDS which is calculated by Tally )

TDS A/c Dr. → Rs 21630

To. Bank A/c. Cr. →Rs. 21630

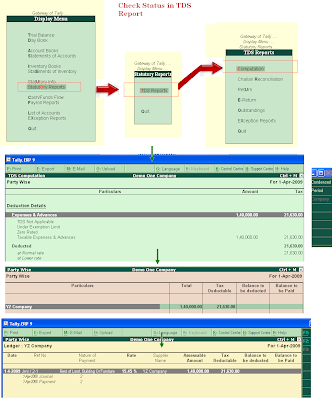

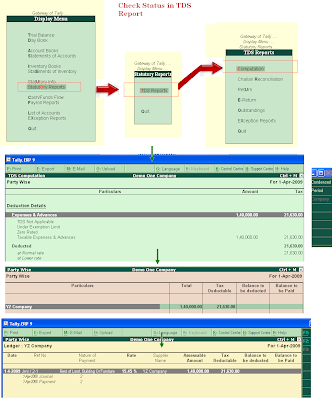

After this you can see the status report in computation of TDS

Gate way of tally >> Display >> Statutory reports >> TDS Report >> Computation

You can also print TDS return directly from TDS reports .

Manual Way

First Step

In Gateway F11 set TDS as No and in XYZ co. TDS applicable- NO.

You enter every transaction in Purchase a/c in Voucher mode not Invoice mode.

Second Step

Calculate the TDS manually suppose it is Rs. 21630 on rent payment of Rs. 140000 (See update amendments of Income Tax Law relating to TDS provisions)

Then after creating normal ledger of party , rent and TDS accounts the following entry will pass

Rent account Dr. → 140000

YZ company Account Cr. → 118370

TDS Account Cr. →21630

( Exempt TDS if payment is not more than 120000 , if more then 10% of payment )

Third Step

At the end of month , Pass the Voucher entry of payment of TDS which is calculated by you in payment voucher .

TDS Account Dr. →21630

Bank Account Cr. →21630

There are two way of accounting treatment of TDS in Tally 9 or Tally.ERP 9 . I am writing both the way of accounting treatment and effect of it is same .

Automatic Way

Following are the simple steps for Accounting treatment , Voucher entries and return making of TDS in Tally.ERP 9 .

First Step

First of all go to Tally 9 Gateway Press F11 and go to Statuary & Taxation and Set Enable TDS as YES.

Second Step

i) Then create a Ledger account in the name of TDS Account under the group Duties & Taxes (Under C. liabilities).

ii) Type of Duty or Tax select as TDS

iii) Nature of Payment- for example you can select Payment of rent on buildings

iv) Ignore TDS Exemption limit- YES/ No

Third Step

(i) Then create another ledger account. For example create YZ. Company under the group of S.Creditors (job work).

(ii) Maintain Bill by Bill- YES.

(iii) Is TDS Applicable- write → YES Enter TDS details like Deductee type- whether Individual or Company. Then fill the required items.

Fourth Step

Then create another ledger account of rent account under indirect expenses.

Fifth Step

(i)Enter the transaction in Journal voucher.

Rent A/c. Dr.→ Rs 140000

YZ co. A/c. Cr. → Rs. 118370

TDS A/C Cr. → Rs. 21630

( Tally will select only one transaction TDS amount automatically , if not activate then calculate yourself and write )

Sixth Step

Then Payment entry ( Write same amount of TDS which is calculated by Tally )

TDS A/c Dr. → Rs 21630

To. Bank A/c. Cr. →Rs. 21630

After this you can see the status report in computation of TDS

Gate way of tally >> Display >> Statutory reports >> TDS Report >> Computation

You can also print TDS return directly from TDS reports .

Manual Way

First Step

In Gateway F11 set TDS as No and in XYZ co. TDS applicable- NO.

You enter every transaction in Purchase a/c in Voucher mode not Invoice mode.

Second Step

Calculate the TDS manually suppose it is Rs. 21630 on rent payment of Rs. 140000 (See update amendments of Income Tax Law relating to TDS provisions)

Then after creating normal ledger of party , rent and TDS accounts the following entry will pass

Rent account Dr. → 140000

YZ company Account Cr. → 118370

TDS Account Cr. →21630

( Exempt TDS if payment is not more than 120000 , if more then 10% of payment )

Third Step

At the end of month , Pass the Voucher entry of payment of TDS which is calculated by you in payment voucher .

TDS Account Dr. →21630

Bank Account Cr. →21630

VEry esay and understable method use hear thanks for help me

ReplyDeleteIt is very nice and easy to understand

ReplyDeletethank you very much

thank to all my dear its easy to understand

ReplyDeleteTHANK U SIR

ReplyDeletevery easy to understand sir, thank you

ReplyDeleteif our client dedudcted TDs from our bill then how to enter that entry in tally?

ReplyDeleteThank u sir it is very easy to under stand

ReplyDeleteI found this information really helpful. Thanks for sharing the informative post.

ReplyDeleteTDS Return Form

THANK U

ReplyDeleteEasy to understand, Thank you

ReplyDeletegood one

ReplyDeletegood

ReplyDelete