I have already explained both TDS under GST and its Simple Accounting Journal Entries. Now, it is very easy for you to understand the voucher entries of TDS under GST and how to pass it in Tally.ERP 9 India's most popular software.

A Situation # If GST is exempt when supply of Goods or Service

In the books of Debtor (Govt. Department or exempted items under GST )

Creditor Account Debit

Bank Account Credit

TDS - CGST Account Credit

TDS - SGST Account Credit

For Example Mr. A supplied exempted goods to Govt. Department of Rs. 1 Lakh and TDS under GST is 1% CGST and 1% SGST

In the books of Govt. Department ( who is debtor of A )

A Account Debit 100,000

Bank Account Credit 98000

TDS - CGST Account Credit 1000

TDS - SGST Account Credit 1000

Process in Tally.ERP 9

1st Step : Just go to Feature of Tally.ERP 9 and Set Statutory and Taxation both GST and TDS Yes

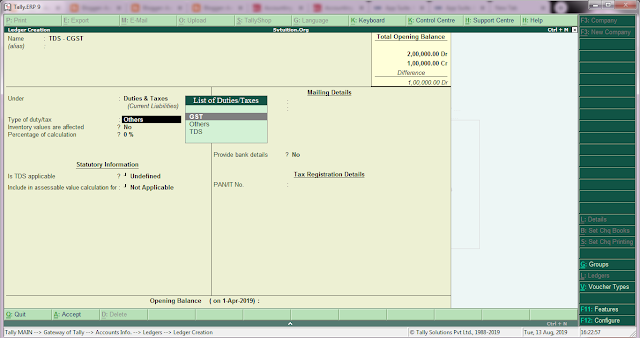

2nd Step : For passing its Voucher Entry in the Tally.ERP 9, we make create ledger TDS - CGST and TDS - SGST under Duties and Taxes and then choose GST. Debtor account under sundry debtors

3rd Step Pass Voucher Entries

First pass the purchase voucher entry

Second pass the TDS under GST Voucher Entry

3rd Pass the Payment Voucher Entry

In Day book, you look like this

We will pass all voucher entries of TDS under GST like this in different situation also.

A Situation # If GST is exempt when supply of Goods or Service

In the books of Debtor (Govt. Department or exempted items under GST )

Creditor Account Debit

Bank Account Credit

TDS - CGST Account Credit

TDS - SGST Account Credit

For Example Mr. A supplied exempted goods to Govt. Department of Rs. 1 Lakh and TDS under GST is 1% CGST and 1% SGST

In the books of Govt. Department ( who is debtor of A )

A Account Debit 100,000

Bank Account Credit 98000

TDS - CGST Account Credit 1000

TDS - SGST Account Credit 1000

Process in Tally.ERP 9

1st Step : Just go to Feature of Tally.ERP 9 and Set Statutory and Taxation both GST and TDS Yes

2nd Step : For passing its Voucher Entry in the Tally.ERP 9, we make create ledger TDS - CGST and TDS - SGST under Duties and Taxes and then choose GST. Debtor account under sundry debtors

3rd Step Pass Voucher Entries

First pass the purchase voucher entry

Second pass the TDS under GST Voucher Entry

3rd Pass the Payment Voucher Entry

In Day book, you look like this

We will pass all voucher entries of TDS under GST like this in different situation also.