Cash flow statement is very important statement of a company, if you can read it, you can take better decision as investor. Everyone can not read cash flow statement like everyone can not read Sanskrit or Tamil or Telugu or other regional languages of India but if a person has determination to learn the any language and give time to read, it is sure, he can read better way and understand same language because human being is learning machine. So, a person never should lazy to learn any new thing.

So, come and today start to learn to read cash flow statement

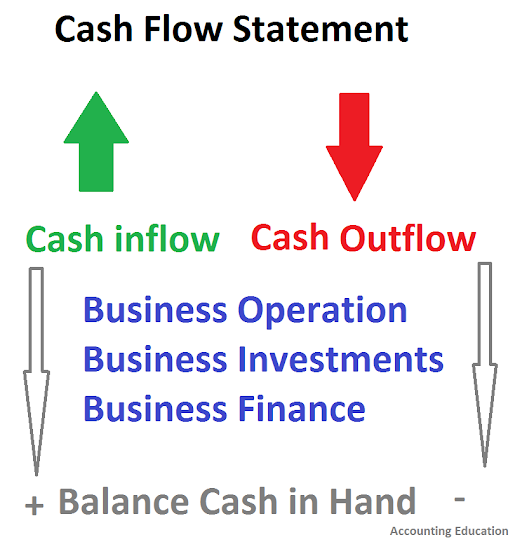

Cash flow statement shows three main parts

1. Cash from operating activities

2. Cash From Investing activities

3. Cash from Financing activities

Now come to read each part

1. Read Cash from operating activities in Cash Flow Statement

Cash from operating activities explains what cash goes from company in operating activities and what cash comes in company through operating activities.

We show inflow of cash from operating activities as positive numbers and make its whole list

We show outflow of cash from operating activities as negative numbers and make its whole list.

You must remember that cash flow from operating activities is only that part of net profit which we get in cash. If we have to find the figure of cash from operating activities, we have to add the figures in net profit which we have deducted in profit and loss account or income statement of a company.

Net profit

+ Depreciation because it is not cash, so, we add it for finding cash net profit

+ Bad debts and provision for bad debts

+ tax expenses

+ Finance cost

+ Advance incomes in cash

+ Credit purchase

- interest income because it is financial income not cash from operating activities

- dividend income

- income from properties

- foreign exchange income

- credit sales

- outstanding incomes

===============================

Net cash from operation

==============================

actually, we are converting our profit and loss account as cash basis of revenue instead accrual basis of revenue for finding the net cash from operation. Learn more detail of cash vs accrual accounting.

If company is generating high profit year after year but its net cash from operating is negative year after year. It is not good signal because it means, company is not getting cash profit and without cash, it is sure to face the struggle to pay salary or other expenses and lack of liquidity, its business may stop in future and as investor, your investment will loss. So, keep eye on cash from operating as investor.

2. Read Cash From Investing Activity in Cash Flow Statement

Now come to Read cash from investing activity. From this list, you can find where company has invested his cash. Which fixed asset it has purchased with cash and from which investment, it has received cash

Inflow of Cash from Investment

Sale of other company shares

Sale of other company's mf

Sales of Land

Sales of any fixed asset

Less Cash outflow in Investment

1. Purchase of shares of other company

2. Purchase of mf of other company

3. Purchase of land

4. Purchase of any fixed assets

5. Bank deposits

6. inter-corporate deposit

7. payment including advance for acquiring right of use of asset

8. payment of purchase of intangible assets

==========================

Net cash flow from investing activity

===========================

If a company has increasing trend to invest money in company's asset, it is good thing. If it is outflow of cash from investing activity, it means, it is decreasing its assets. So, it has to read carefully what to do the company in investing activity.

sponsored link : Start investing with SBI Securities!

2. Read Cash From Financing Activity in Cash Flow Statement

1. Issue of new shares

Less Cash outflow

1. Cash paid for redemption of debenture

3. Interest Paid

COMMENTS